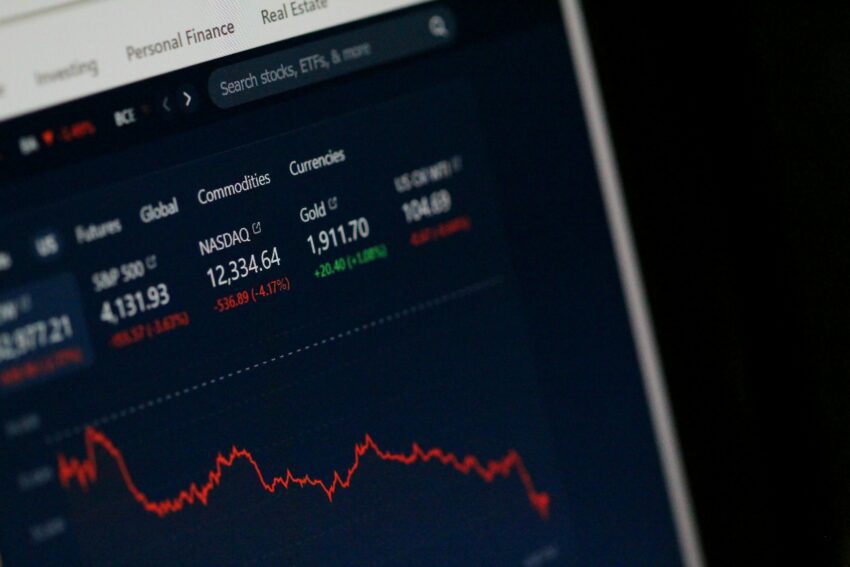

In the last week, the internet has been buzzing with information about the crash on Wall Street. In a matter of seconds, a peaceful and stable stock market has turned into an unsafe place for companies—even for the big ones. People are stressed, investors are more cautious, and large companies count the money they lost in the crash. But what does it mean for startups? Will they feel any impact?

Crisis Follows Crisis

A week ago on Friday, the U.S. released a disappointing report on the labor market and unemployment. The data showed weak employment growth and an unexpected increase in the unemployment rate. Dissatisfied with the report, investors quickly shifted towards safer assets, leading to a significant drop in company shares. The changes also hurt the shares of the largest companies that dominate the stock market, including Nvidia, Meta Platforms, Microsoft, Alphabet, Amazon, Tesla, and Apple.

Crisis vs. Startups

Many may think that a stock market crash won’t affect the technology sector or the global economy. Unfortunately, situations like this often have a greater impact than anticipated, and startups can feel the consequences the most. Why?

- During stock market declines, investors become more cautious and may reduce their investments in tech startups. Venture capital funds may also struggle to raise new capital, limiting their ability to invest.

- Large tech companies may be less inclined to make acquisitions during stock market downturns, reducing potential exit opportunities for startups.

- Stock market declines can prompt startups to cut operational expenses, impacting product development, hiring, and market expansion.

These challenges are just the tip of the iceberg. So, what can startups do to protect themselves from the negative effects of a stock market crash?

Be Ahead of Problems

There are a few ways to prepare for situations like these. It’s worth remembering that relying on diverse strategies and safeguards is often better than trusting only one. Here are our startup tips on how to prevent unexpected consequences:

- Diversify Sources of Capital: Don’t rely on just one source of funding, such as venture capital. Consider other options like bank loans, grants, crowdfunding, or strategic partnerships.

- Build a Financial Buffer: Accumulating cash reserves can provide financial flexibility and stability during tough times. Aim to have enough money for at least 12–18 months of operating expenses.

- Diversify Customer Base: Avoid relying on a single market or customer segment. Expand into new markets or diversify your product offerings to reduce the risk associated with losing customers due to a stock market crash.

- Relocate Your Team: Consider transferring your team to another country where costs are lower. Finding a foreign team that does the job at a lower cost than your local team can help you reduce expenses without downsizing.

There are plenty of ways to mitigate the impact of a market crash, and we can help with one of them. Choose us and deploy your team in different parts of the world. We are a Polish IT company with a team of young, talented programmers in Krakow. What sets us apart is the best quality for an affordable price. Our rates are competitive with those of IT services in many countries, and the quality of our applications and websites is top-notch. So, choose our safe and effective solution and prepare your startup for technology crises.

If you want to learn more about our offerings, visit our website or contact us. We’re here to help your startup grow with affordable prices and the best quality.